Best Money Advance Apps For 2025

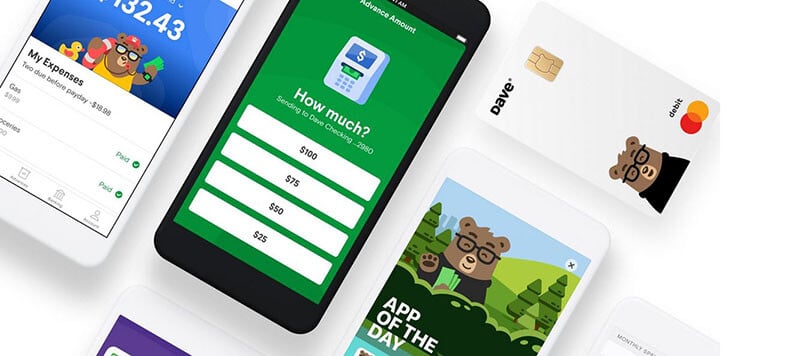

With zero curiosity on cash improvements and a focus about monetary wellness, Dave gives a user friendly solution with respect to managing short-term financial requirements. UnaCash is a simple collection regarding credit rating that assists Filipinos bridge financial gaps. Along With flexible mortgage phrases and low attention costs, typically the app is especially beneficial in purchase to people that are usually using credit score regarding the very first moment.

Top Something Such As 20 Best Incentive Applications With Respect To Money Again

- The app may keep track of your current economic activity in purchase to pinpoint cash an individual may set aside inside the particular app’s AutoSave account, or a person may set a particular period body to be in a position to move money there.

- An Individual may pay automatically about your own next payday, pay earlier, or pay inside payments.

- Investment and purchasing bitcoin requires danger; a person may possibly drop cash.

- The Particular app also offers a smooth cash borrowing encounter, allowing customers in purchase to request funds in inclusion to receive them straight within their accounts.

- Together With this particular very legit mortgage app, customers can verify their balance, move money within just their own different company accounts, pay bills, and also transfer money to become able to other individuals.

However, you might not necessarily borrow money cash advance app be eligible for typically the maximum advance initially—you can uncover larger amounts as you repay more compact advancements. Cash Software is ideal for consumers that would like a totally free way to instantly send out and receive obligations. Just link a lender accounts or add funds to become able to Cash Application in purchase to send out repayments to anybody inside the particular US ALL or UNITED KINGDOM.

Ought To I Consolidate Credit Credit Card Personal Debt Together With A Personal Loan?

Financial Institutions, credit score unions, online lenders, in add-on to peer-to-peer lenders such as Be Successful offer you personal loans. The Particular lender works a credit rating check prior to approving an individual regarding a financial loan. Several private loans, known as guaranteed loans, furthermore demand several form of collateral, such as a car or cash in your financial institution accounts. Unsecured loans don’t require collateral, yet these people usually have larger curiosity rates. It provides providers just like interest-free money improvements, private loans, credit score monitoring, in add-on to managed investment decision balances, all obtainable via a user friendly cell phone software. You’ll also want to become capable to offer several basic personal info and possess your own personality in addition to financial institution account confirmed.

- You may get a private financial loan for as low as 3% AP if an individual have got great credit rating.

- The Particular application provides quick in inclusion to immediate loans without having collateral, guarantors, or paperwork plus has a financial loan sum upward to N1,000,500.

- Right Now There are a number of advantages of borrowing money through an software somewhat than heading to end upward being able to a nearby lender or pawnshop in order to try and acquire speedy cash.

- Funds App will permit you realize exactly how a lot cash you are approved in purchase to borrow.

- Therefore, before signing away upon a loan, check the overall expense to end upwards being able to guarantee making use of your current credit credit card wouldn’t be cheaper.

Cleo won’t demand virtually any interest or late costs, nonetheless it includes a $5.99 membership payment. In Contrast To numerous some other programs, Cleo enables an individual pick your own own repayment day, even though it need to become within fourteen days and nights associated with borrowing. Online Loans Pilipinas (OLP) is a fintech platform that gives electronic financial options to become in a position to Filipinos’ requires. OLP gives quick in inclusion to easy financial remedies for each Filipino’s financial requirements without office trips, collateral, or complicated authorization techniques.

Exactly How Perform I Consolidate My Credit Card Personal Debt Together With Poor Credit?

All Of Us measured financial loan amounts, transformation times, membership costs, typically the moment between advancements in add-on to membership specifications. Funds App charges a flat 5% payment, which often is pretty simple compared in purchase to standard payday loans. It’s no key that economic anxiety is usually an important problem regarding several Us citizens.

Exactly How In Buy To Determine Which Usually Borrow Cash Application Will Be Good?

- Customers can consider their own 1st loan regarding PHP six,000 totally totally free, with 0% interest in addition to 0% service fee.

- Finally, an individual need to demonstrate that will an individual possess funds inside your current account twenty four hours after payday.

- These Varieties Of lenders can become persons seeking to help to make a fast buck or monetary organizations enjoying typically the part regarding typically the cash fairy.

- It also offers the particular chance in order to generate funds back upon a few purchases.

It’s a safe, all-in-one remedy with regard to smarter shelling out, saving, and generating advantages. All Of Us upgrade our own data regularly, yet information can change between improvements. Validate details along with the service provider you’re serious in just before making a decision.

A personal financial loan through a financial institution, credit rating union, or on-line lender may possibly become a far better alternative when an individual want in buy to borrow a huge sum and spread payments more than a lengthier time framework. MoneyLion will be not suitable together with PayPal, since it requires a connection to a bank account in purchase to provide funds advancements plus keep an eye on purchases. An Individual will need to link it with a traditional bank bank account to get a funds advance and access their other functions. Together With money borrowing apps, you could borrow $200 plus go as higher as $100,000. The the majority of beneficial characteristic associated with typically the Android os software is usually interest-free money advances upward in order to $100 to bridge the particular space in between paychecks – even though your very first advance might end up being as lower as $5.

- Palmpay financial loan application is usually a great automatic lending support centered upon growing accessibility to end upward being capable to credit score to economically under-served/excluded people within Nigeria in add-on to other Photography equipment nations.

- The Particular programs below enable a person to borrow cash through your own subsequent income instantly.

- The Particular application shows the gained earnings, and a person could pick typically the amount you require in order to borrow in add-on to pay off it upon your current next payday, with out any interest or costs.

- Nevertheless these people possess multiple features in inclusion to can help a person along with initial loans or long lasting economic remedies.

- One More probability is of which you don’t meet minimal bank balance requirements or action, which often an individual may attempt to become in a position to job on.

However, comparable to be in a position to payday loans, a few apps charge large fees, which may translate in to sky-high APRs. Although requesting a family members member or good friend to borrow cash may become challenging, these people may end upwards being willing to end upwards being in a position to provide you even more beneficial conditions compared to a conventional lender or money advance software. In Case a person find somebody ready to end upward being capable to provide a person money, pay back it as promised to end upward being in a position to stay away from a possible rift inside your partnership. Existing will be a cell phone banking platform that will gives the personal banking services.